This is the first post in a series: Maccas to Million$ – A mini-series of lessons learned from McDonald’s and how it helped us buy, fix and sell the Silverspoon – A local restaurant that was about to close its doors. Find out more about the series here.

Our First Accountant

Our first accountant was an older Chinese gentleman. Tall, thin, and balding with a sparse combover, he was softly-spoken. As per the custom, he had chosen an English name, Raymond. Despite his English being difficult to understand at times, I really enjoyed the conversations I had with Raymond about business and money. He played a crucial role in us purchasing the restaurant.

Once we had entered into a purchase agreement with the old owners, we had to do a few things to move forward. Ian, my father-in-law, had agreed to loan us the extra money required and become a silent partner in the business, one of his conditions was that we got an accountant to check out the books and examine our plan of how we would make a profit.

As Ian was based overseas at time, finding a local accountant was completely up to me. And that’s where Raymond came in. I was driving down main street and noticed a sign outside his office saying that he specializes in “Small Business Accounting.” “That sounds like us,” I thought and I walked into Raymond’s office.

It was large space, big enough for four or five workers, with an unmanned reception desk. In the back corner was a glass cubicle where I found Raymond working. He waved me over, and I took a seat. His desk was piled with stacks of financial papers, the back wall was lined with filing boxes, and there was just enough room for his keyboard and a warming pad on which his coffee sat.

I discussed the restaurant with Raymond, and my plans to fix it up. Raymond’s price of $100 an hour sounded much more reasonable compared to the quotes of $2000 or more I had been receiving. He estimated that it would take about four hours to complete the assessment. We agreed to catch up the following Tuesday after I had emailed all the documents he needed.

It’s got potential, but fix the formula.

As it got closer to my Tuesday appointment, I started to get more and more nervous. I was still building full-time, and we were feeling very excited at the prospect of finally becoming restaurant owners. It felt like it was no longer just a dream.

Tuesday afternoon came around, and I was sitting in Raymond’s office. I was honestly thinking Raymond’s report was going to come back saying the whole thing was a dud.

The business had potential, but it was losing money.

I remember him saying several times that the formula was wrong and needed to be fixed; each time in my head I was thinking, “Mate, don’t worry about the formula. I know what I doing.”

A lot of things were said in that meeting, but what I remember most is his saying that his recommendation was to buy it. I was shocked. I really hadn’t been expecting this answer. We could buy it? I immediately forgot about the formula and got in touch with Ian to share the news.

I sometimes wonder what other accountants would have said; would they have seen the value in the business the same way Raymond did, or would they have recommended we run the other way?

Our Plan to Grow Sales

Using McDonald’s training, I looked through sales on a shift-by-shift basis, listing it all into a spreadsheet. There were shifts that did really well, and then there were shifts that didn’t break even. Food cost and labour cost were way too high, these are your two biggest costs to control in a food business.

I thought the part of the broken part of the formula was that it needed to make more sales. We believed with increased turnover these problems would resolve themselves. We set a goal to grow turnover, specifically to 1 million a year, and this became the overarching theme to everything we did.

Grow sales to 1-million-a-year turnover, and all our problems would be solved.

Before we opened, our family and friends had spent two full weeks giving the place a major makeover. We scrubbed grease off all the walls inside and then freshly painted them Quater Spanish White. We replaced old paintings, light fittings and other decorations. We cut the fence down outside to open it up to the public and gave what was left of the fence and balcony a fresh coat of paint. One wall of wallpaper for a focal point, brand new steps into the carpark, beautiful gardening to greet our guests.

Once open, we put a massive focus on excellent food, coffee, and service. In order to achieve this, we invested heavily in staff and in training them. We made sure every shift had ample cover. We were very active in the business and could see that sales were starting to rise, and we were beginning to feel good about our growth plan.

Sitting in the Back Office

About a year and a half in, Raymond set up a meeting to review the first full set of financials. We had loosely followed the figures month-to-month and knew that they weren’t doing amazin. We were still convinced that with growth the profit would come, so we put the bad months down to “the cost of growing.”

I had the meeting with Raymond and went back to digest what he had told me. Despite all our efforts, the restaurant was stilllosing money. This news was a major blow. We had spent the last year and a half doing things to get bigger, grow the business, increase sales, and for nothing it seemed.

That night back at the restaurant, everything was under control out in front, so I was sitting in the back office. It was dark, dingy room that we hadn’t gotten around to freshening up, chock full of stuff we had inherited when we got the restaurant. Stuff we didn’t use or know what to do with, but we felt (mainly me) that it was too good to chuck out. I heard the typical restaurant noise in the background – pans clanging, dishwasher running, chef yelling. I found the ambience somewhat soothing and took the time to reflect on my earlier discussion with Raymond.

The meeting had gotten quite heated. Raymond kept talking about the formula and more specifically that we had done nothing to improve the formula. At first, I took this quite personally and got defensive. I was convinced that with more sales, all our problems would be solved. Right? That the money would start rolling in, things would just click, and it would all get better. “Just you wait,” I thought, “We’ll show you; when sales grow we will start making

Sitting down and reading those financials was a bit of a reality check that strictly from a financial point of view we had gone nowhere that year. Sure, we had renovated, paid the renovation loan off, and put a new burst of life into the place; we’d improved the culture, improved service, and increased sales, but financially we weren’t actually doing any better than the old owners.

Raymond challenged us to stop thinking about growth and start thinking about the formula.

The phrases “The formula is broken” and “You need to fix it” kept circling around in my head.

Finding a new coffee supplier

Before we even thought about owning a restaurant, Katie and I were obsessed with a good cup of espresso coffee. Coffee Supreme was one of the original Wellington Roasters and known for having a great bean, blend and roas. With a really strong culture of training, they took it seriously and had a certification program you had to pass to be able to serve their coffee.

However, as they pushed into Auckland and Australia, I felt like their standards had slipped. The change of ownership was the perfect time to shake things up with suppliers, and coffee was the first on our list to change.

We listed out some potentials, and Ripe, Caffe Laffare and Peoples were top of the list. We rang each company and told them we were buying a cafe and wanted to change suppliers. At the time, we felt like changing coffee suppliers was a big deal and they should be honored to potentially have our business. All three companies left us feeling worse off about the decision.

- Ripe drilled us with questions, mainly about volume; pretty much we weren’t big enough for them.

- Peoples were quite snobby to us, we think because we were Upper Hutt based, they ended up saying they “just aren’t taking on any more customers right now.”

- Laffare was good and professional, but it just felt really corporate.

Eric from Emporio

Then somehow, we stumbled across Emporio, owned by an

We turned up 5 minutes early and waited for Eric. He arrived

We moved onto the training room where a large coffee machine sat front and center. Eric proceeded to makes us an amazing flat white without even really trying, and we sat in the back of his roastery talking for about an hour. We talked about our experience at McDonalds, the Silverspoon, and what we were looking to do with it. It felt like Eric was hanging off every word we said. He was so enthusiastic and supportive and made us feel like there was no way we could fail.

At the end of that Saturday morning meeting, our coffee account was undoubtedly Eric’s.

What We Thought vs. Reality

We thought we knew what we were doing. We had snagged the place at a bargain price and just needed to grow sales to start making money.

By focusing on amazing food, coffee, and service, the news would spread and people would flock to us. We didn’t have a bank loan and weren’t sucking money out of the business. We had used our hands-on skills to put in hundreds of free hours into giving the place a makeover.

Off course we took pride in the place, the staff that worked there, and the reputation. There was a sense of satisfaction when people introduced us as the “owners of the Silverspoon.” However, the intention of buying the business was to get it turning a profit again.

We realized we didn’t know what to do next,

otherwise we would be doing it already.

It was a crucial turning point. Do we carry on down this track, and in 5 years’ time, still be holding onto this dream that “someday” when sales increase just a little bitmore it will get better? Or do we make a serious change in approach now?

I thought about Eric from Emporio. What would he do? In his own words he had “done up and sold a few cafes.” He remembered working crazy hours painting until midnight the week before he opened and arriving at 6am to make a days’ worth of Panini’s.I knew he could relate to us.

I gave him a call to discuss our situation. His advice was to detach ourselves from the business emotionally. Look at it critically and “run it like you’re going to sell it” (just to be clear this does not mean running it into the ground but quite the opposite).

He reminded us that we are not going to own the place forever and encouraged us to work backwards from a sale:

- To sell it (for a good price) you need a good set of financials,

- For multiple years in a row,

- Showing a healthy a bottom line profit.

A bottom line profit only exists when you consistently spend less that you earn.

I started thinking more and more about Raymonds “Formula.” What if he was right? What if we focused on the formula, instead of focusing on growth?

What did we actually do?

We got realistic about our current situation. We wanted to start making a profit and now.

“If you take care of the small things, the big things take care of themselves.”

We focused on making the formula work for the current amount of turnover we had instead of running it like someday it will make over a million dollars or waiting until we make another big change. One of the key lessons we had learnt at McDonald’s was that they managed to make a profit on a shift-by-shift basis.

Somehow, we had lost this because we thought we needed to fix the business first. In order to get the overall financials right, McDonalds broke the business down into tiny “units” and focused on the profitability of each one.

I started to think about Raymond’s Formula:

What should food cost be?

What should labor cost be?

What is a realistic profit %?

We then started to look at how we could achieve this for every $1000 of sales.

We still had a minimum sales target, but I vividly remember shifting the mindset from growing sales to making it work with what we have currently. If sales only ever grew at the pace of inflation (this needs to be your bare minimum growth) how would we manage the business to get 10% bottom line?

Whats next?

Doing more of the wrong thing is not going to help. It’s not going to magically get better because you hit a certain amount of sales. More sales will only multiply your current situation. If you’re losing money (i.e. not making a profit), more sales will only magnify this and make that hole bigger; you will slowly be digging a grave for your business.

Until we completed an honest reflection of our current situation we couldn’t move forward. Once we accepted that more sales were not the answer we could begin to plan effectively.

My next post in the series will discuss how we set about fixing the formula.

For now the most important part

where you are, and where you want to be. is understand

Below is some questions and an activity to help you think through this.

How does this relate to you?

Think about what you’re in the middle of right now. It could be a new business, a goal, or a project like a home renovation.

What were your hopes and dreams before you set out?

Think back to what you were thinking when you first took this on: How does that line up with were you are currently? Like us, it’s easy to lose sight of your original enthusiasm once you are in the thick of it. It’s also easy to feel like you have lost your way or are going around in circles. Write down and reflect on what your original goals were when you set out. It’s also a great idea to document what you’re thinking before you take on your next big project.

What advice have others given you that you are ignoring?

It took a year and a half for Raymond’s advice about the formula to sink in. Be careful not to be so focused on your own vision that you ignore anything that doesn’t line up. Sometimes it’s the way that people communicate their advice. Also be careful what advice your following, Make sure the person giving the advice has the experience to back it up. Don’t listen to every tip random people give you, you will go around in circles.

What are you holding onto? (that’s not helping you)

We were so focused on growing the business that we ignored little warning signs and convinced ourselves it would all work out when we grow. It’s ok – and common – for the vision that you started with to change as you go along. Do an honest assessment of your current reality, and make plans from there.

How can you break your business, goal, or project into smaller units?

Find a common unit For your business, it could be $100, $1000, $10,000, or $100,000. For every unit, decide your ideal scenario and how you will manage to achieve this as well as how much should be allocated to each major cost, including profit.

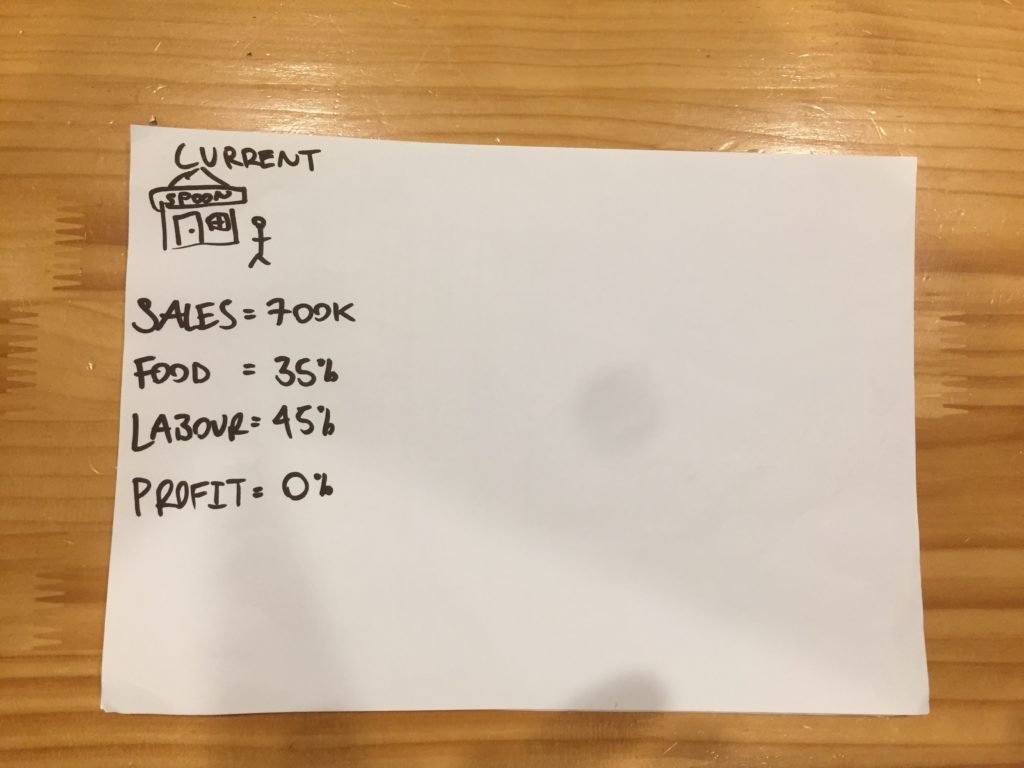

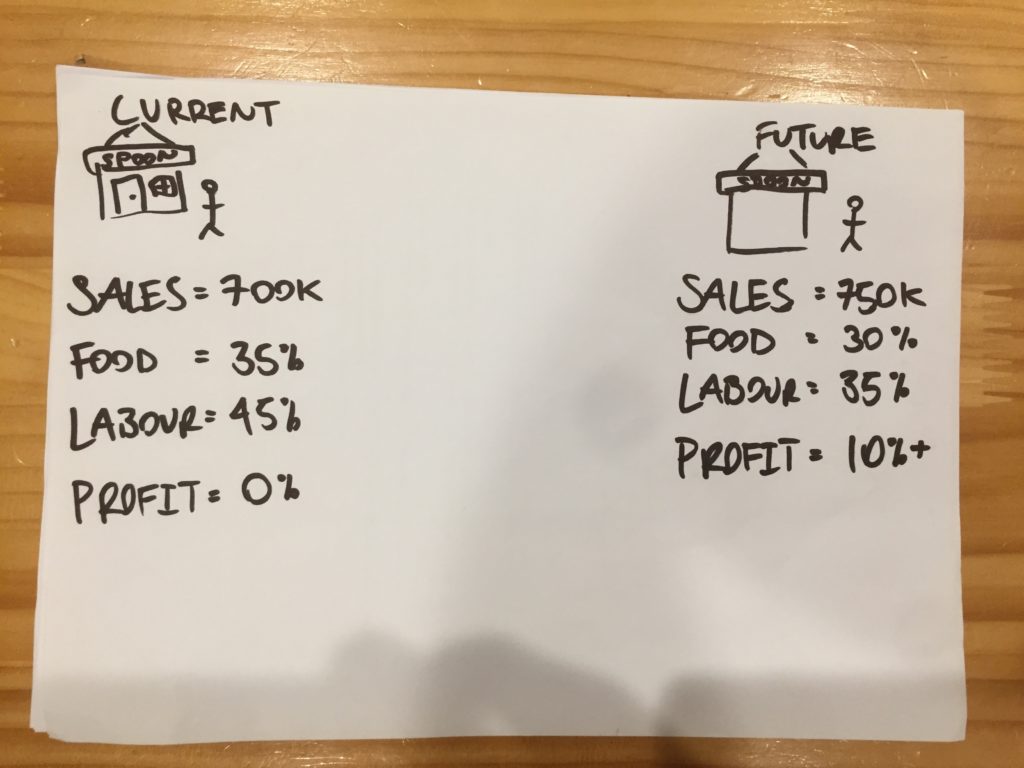

Activity: Road Map Current Reality to Future Vision

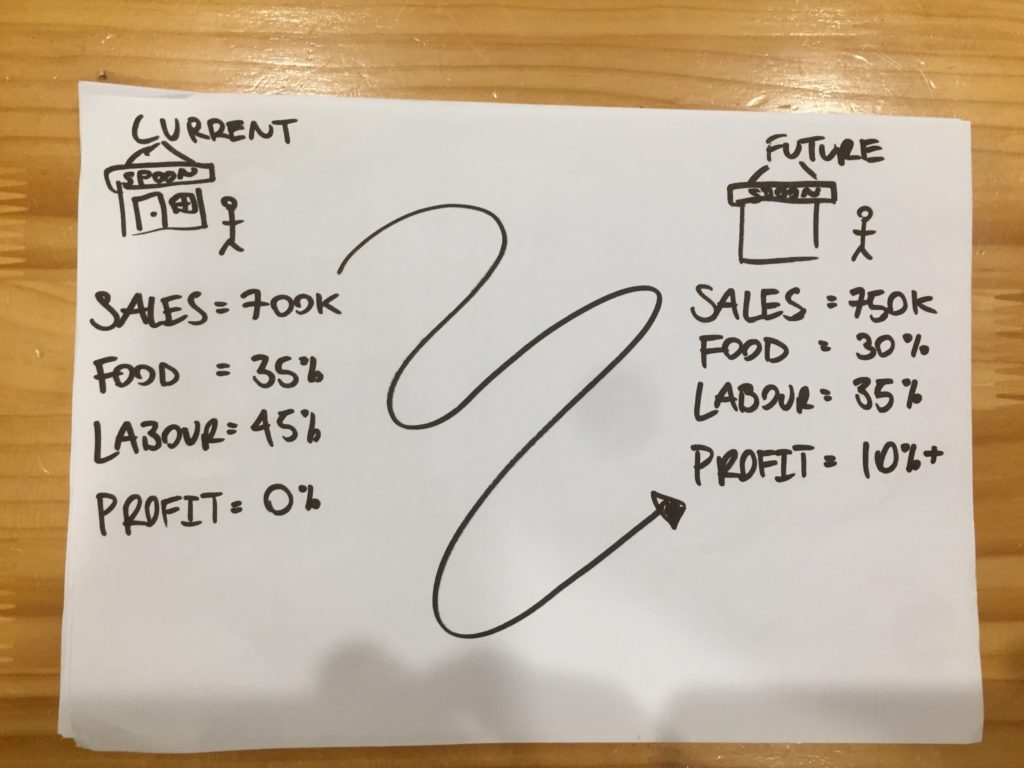

I have used this planning method as a simple, yet effective way, of getting the goals out of my head and onto paper. By putting them on paper it helps me visualise what I need to do next to move forward (see below examples)

Sit down with a piece of a4 paper, in landscape mode.

On the left side, draw a stick figure and a really basic, little business; that’s you and your shop.

List out your current reality:

- Sales,

- Key costs (in a restaurant it’s food and labor)

- Number of hours you’re working

- Bottom line profit Anything else that’s top of mind (make it specific to your situation)

These will become your KPI’s, and we will talk about these later; for now, all you need to know is what they are currently

On the other side of the page, draw another little stick figure and business; that’s your future self and business. List out where you would like those things. If you don’t know, that’s ok. Just put a large ?for now.

Now draw a giant squidgy line with an arrow on the end across the page from your current reality to your future reality. For now, it’s only important that you realise where you are, and how that measures up with where you want to be.

I will talk more about planning in a future post, in the meantime check out This recent post helps when you’r not sure what to do next – https://joshfrom.nz/index.php/2019/01/27/take-another-small-step/