“You either master money, or, on some level, money masters you.” – Tony Robbins

A couple of weeks ago, a friend asked if I had any good books on money. I have definitely read my fair share of books on money. So I suggested he come around for a beer, and we talk about what he was looking to achieve.

“Something to follow on from Rich Dad Poor Dad,” was his request.

There is no doubt that Rich Dad Poor Dad is inspiring and a great start on thinking about your finances. However, Nick felt when finishing the book that it leaves you wanting more specifics. How exactly should I invest? How should I start? What should I invest in? He is not alone; this is exactly how I felt after Rich Dad Poor Dad, and others I have spoken with felt the same.

So here are the 2 “money” books I recommended he continute with. One is a nice, easy-reading story, and the other is a more thorough breakdown interviewing successful investors.

The Richest Man in Babylon by George S. Clason

This book is very easy reading and aims to pass on timeless principles in a story-based format. While the language is very “old school,” the lessons it teaches are a good starting point and able to be put into action immediately.

The key principle that I took away was this: “A portion of all I earn is mine to keep.”

I pictured a portion of our weekly income going to Pak N Save, Caltex, Insurance, Westpac, and all the other things we spend our hard-earned dollars on. I pictured giving all these corporations all our money and having nothing left for ourselves. I started to think about what I could do to have something left over for us to save and invest.

If I was going to sum this book up in 1 sentence, I would say this –

It’s not how much you earn; it’s how much you keep that matters.

MONEY Master the Game: 7 Simple Steps to Financial Freedom by Anthony Robbins

At first, I was sceptical about a money book from Tony Robbins. It was only when Tim Ferriss interviewed him on a podcast that I decided to give it a shot. The book is written from a USA perspective; however, I like that because it forced me to think about how it applies to me here and to look for New Zealand equivalents.

Early on, Tony makes it clear that the only person responsible for your financial success is you and sums it up nicely with this quote:

“You either master money, or, on some level, money masters you.” – Tony Robbins

Here are the key takeaways:

- Excessive fees will erode your returns.

- Don’t try to time the market. Start as soon as possible with small and regular contributions and how the power of compounding will help grow this.

- Define what financial freedom looks like and put an actual number on it. How much would you need week-to-week to not think about working again? Focus on this rather than focusing on a large figure like 1 million dollars.

- Here is a good review of the book.

Other books worth mentioning:

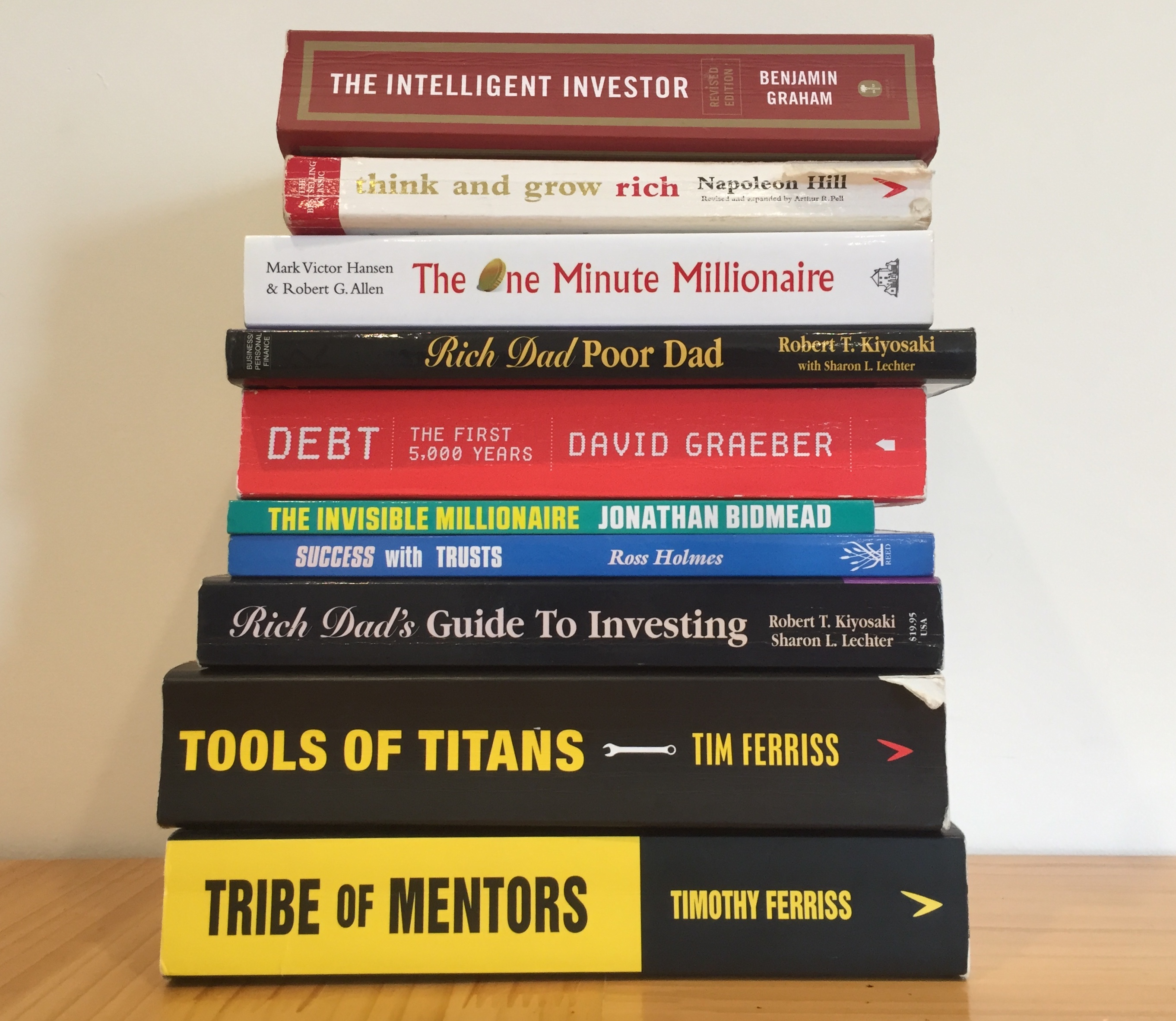

- Think and Grow Rich by Napoleon Hill: There are certainly some weird aspects to this book, and at times it lost me. However, I stuck with it, and it was worth it. The key theme is the power of the mind – when there is a will, there’s a way. It’s worth doing the exercises and actually writing down your answers.

- Tribe of Mentors and Tools of Titans by Timothy Ferriss: I really like how Tim Ferriss drills down on specifics. Often, it’s the simple things that work, not the complicated.

- The Intelligent Investor by Benjamin Graham: Benjamin Graham was Warren Buffett’s mentor. Again, the book is a heavy read and quite USA-focused but still worth reading. My key takeaway from this book was how many times it drummed in not to chase the highest returns possible but to aim for consistently average returns, letting them compound over time.

- The Invisible Millionaire: this is written by a kiwi guy. While it’s heavily focused on rental properties, I like the principles and his philosophy, especially about building wealth without showing it off. He makes some very valid points about re-investing your returns instead of blowing them on things like the latest TV.

- And if course, Rich Dad Poor Dad.

If you can’t be bothered reading all the books above, here is my summary of the steps to financial freedom 🙂

❏ There is no get-rich-quick schemes. Almost all these books drum this in. They all talk about the importance of starting now. Do something small; even if it’s $5 a week, put it away, and start it growing. The hardest part is starting!

❏ Control and reduce your weekly expenses. This doesn’t mean not living life. They all encourage you to live life to the full, have fun, and make the most of your moments, but you can do this without having to always spend 100% of your income.

❏ Look for ways to increase your weekly income.

❏ Build an emergency fund of 3-months living expenses.

❏ Pay down the mortgage (because you are paying this out of your post-tax dollars, this is where you can make the most immediate impact, and it reduces the compound effect of interest).

❏ Make sure

❏ Look at index funds. A property index fund is also a good option if you have been thinking about investing in the property market.

Which one of the steps are you currently working on? Comment below, and share your inspirations.

—-

PS – Hit me up to borrow any of the above books, and as always, I would love to talk about what you’re reading over a coffee or beer 🙂